Back to articles list

Back to articles list

Trading cryptocurrencies, buying stocks, and the like is extremely popular these days – it’s perceived as easy profit. Prices are currently rising, but we can’t know when that will change. On the other hand, we know it will at some point. But we’re not here to make financial predictions. Instead, we’ll talk about a data model that can be used to support the trade of cryptocurrencies and financial instruments like stocks or fund shares.

What You Need to Know About Trading Currencies and Shares

Technological improvements in the last few decades have had a significant impact on trading. There are now many online trading platforms you can use. Most of today’s trading is done virtually – you can see paper stocks in museums, but you’re not likely to see the stocks you buy in paper form. And you don’t need to pack your bags and head to Wall Street or any other stock exchange to make a trade. From the comfort of your own computer or mobile device, you can buy or sell financial derivatives (such as bonds, shares, or commodities).

Most trades (sales of financial derivatives) follow the same rules. There are sellers and buyers. If they agree on a price, the trade happens. After the trade, the price of that financial derivative will be recalculated and the process will continue with new traders. Shares and other derivatives work the same way.

What is cryptocurrency? You’ve probably heard of Bitcoin and other cryptocurrencies. But what are they? Cryptocurrencies are like virtual currencies, but they’re not tied to real-world currencies (like euros or dollars). Instead, users can trade cryptocurrencies amongst themselves like tokens. They can then negotiate a sale that turns their tokens into actual money. These sales function exactly like the stock and share trades described above.

This subject is complex and we could have a lot of details in our model (e.g. records of documents and transactions). I’m going to keep it simple; I won’t implement any kind of automatic trading or any formulas to generate new prices after a trade event.

So, let’s take a look at this simple trading model.

The Data Model

The data model consists of three subject areas:

CurrenciesItemsTraders

We’ll present each subject area in the order it’s listed.

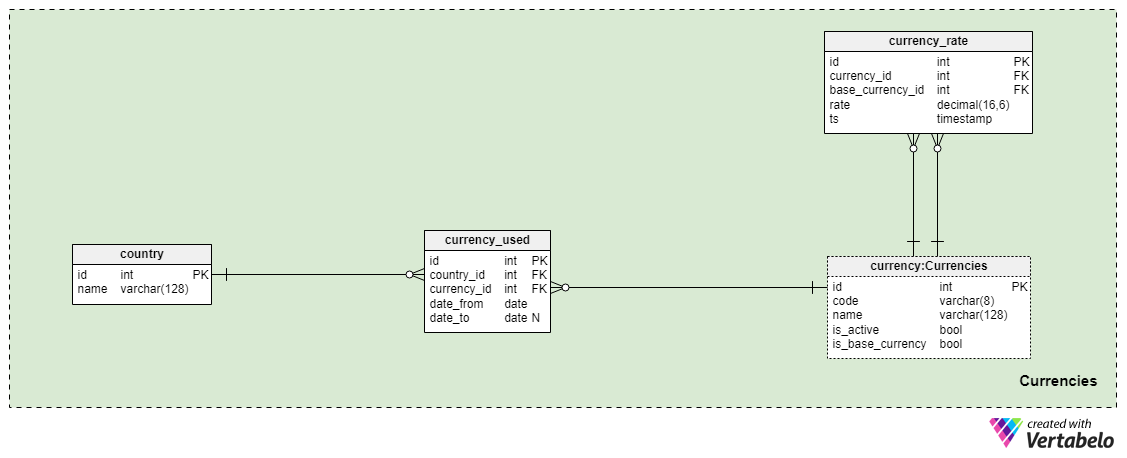

Currencies

The Currencies subject area is simple. It contains four tables that store every currency we use and their exchange rates. Currencies are important because:

- We will use one currency, called the base currency, for trading. An online stock trading platform will likely use the U.S. dollar (USD) as its base currency, regardless of the traders’ actual regions. All transactions will be converted into the base currency.

- We can also have non-base or local currencies for all the countries where our trading platform is available. This would allow us to display prices in the local currency but still perform trades in the base currency.

The remaining two tables relate currencies and countries.

The most important table in this subject area is the currency table. This is where we’ll store all currencies we’ve ever used for trading, including cryptocurrencies. Whether a currency is included in this table depends on if that currency will be used to pay for the traded items. For each currency, we’ll store:

code– A code used to UNIQUELY denote that currency. For national currencies, this will be the ISO 4217 code (e.g. USD for United States Dollar) or some other official code. We could also use ISO 4217 for cryptocurrencies; XBT is Bitcoin’s ISO code. However, Bitcoin also uses the code BTC informally.name– That currency’s UNIQUE name (e.g. United States Dollar).is_active– If the currency is currently active in our system.is_base– If this currency is our system’s base currency. Usually, we’ll have only one base currency at a time. It’s possible we could have more than one, such as using euros for EU states and US dollars for other areas. In that case, we have the capability assign a base currency to each country with this attribute.

The next table stores current and historical rates between currency pairs. In the currency_rate table, we’ll store the currency_id we want to compare to a base_currency_id as well as the rate when this pair was stored (ts). Since we’ll store rates as they were at various points in time, this table will store both historical and current data.

A list of all relevant countries is stored in the country dictionary. Besides the primary key (id), it contains one attribute that holds a UNIQUE country name.

The last table in this subject area is the currency_used table. In most cases, a country will always use the same currency. Still, changes can happen, like when many EU countries replaced their national currencies with the euro. To cover such an eventuality, we’ll store a history of all the currencies we’ve used. For each record in this table, we’ll store references to the country table (country_id), the currency table (currency_id), and when this currency was used (date_from and date_to). If date_to is NULL, then this currency is currently in use. Of course, only one currency should be in use per country. We won’t implement that check in the model; instead, we’ll perform a check when a record is added or updated in this table.

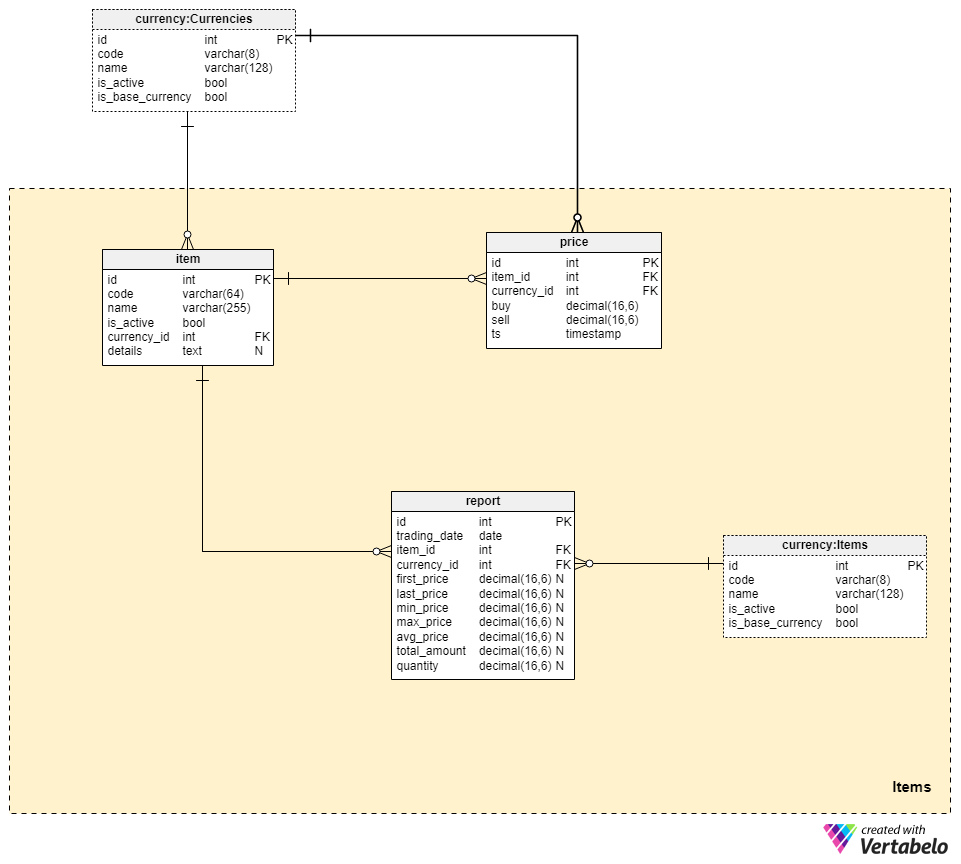

Items

Tables in the Items subject area define all items available for trade and their current status. It also records all changes that happened to these items over time.

The item table lists all items that traders can buy or sell (or that they have bought or sold). These could be stocks, funds, or cryptocurrencies. Any trade involving these financial instruments uses almost exactly the same process, so we can use the same structure for all of them. For each item, we’ll store:

code– A UNIQUE text code for that item, similar to what we use for shares (e.g. NASDAQ uses the code “AAPL” for Apple Inc).name– The full name of the company (for shares), fund, or cryptocurrency.is_active– Whether this item is available for trade or not.currency_id– References thecurrencyused as base currency for this item.details– All additional details (such as the number of shares issued) in textual format.

The price table tracks all price changes across time. Once a change has occurred, we’ll store the time (ts), and the buy and sell price for the item (item_id) involved. We’ll also store a reference to the currency table, which tells us the currency used to set the value of that item at that time. Notice that preferred currency for any item could change.

The final table in this subject area is the report table. The idea is to store regular (i.e. daily) reports for each item. This report will be based on trading during that period, and it will keep financial details in one place. This is redundant data, but it can prove to be very useful when querying historical prices (which happens often, as traders are extremely interested in trends). For each record in this table, we’ll store:

trading_date– The date of this report. If we need to compile reports more often than once a day, we’ll have to make changes to the model – e.g. adding timestamps that indicate when a trading period began and ended.item_idandcurrency_id– References the relateditemand thecurrencyused.first_price,last_price,min_price,max_priceandavg_price– The first, last, maximum, minimum, and average price for this item during this period.total_amount– The total amount paid for that item during the reporting period.quantity– The number (quantity) of items traded during this reporting period. Please note that an average price could be calculated fromtotal_amountandquantity, but I prefer to keep “total_amount” separate. This simplifies the situation when we create a report for a longer time period, such as weekly. In that case, we could add all thetotal_amountattributes and divide them by the sum of allquantityattributes to get a weekly average price.

All attributes in this table (other than the primary key and the foreign keys) can be NULL. This will be the case when we insert a record for a new trading period – there are no trades so far. At the beginning of each date, we can expect we’ll insert one record for every item and update these values as the day progresses. The final updated value will also be the final report for that day.

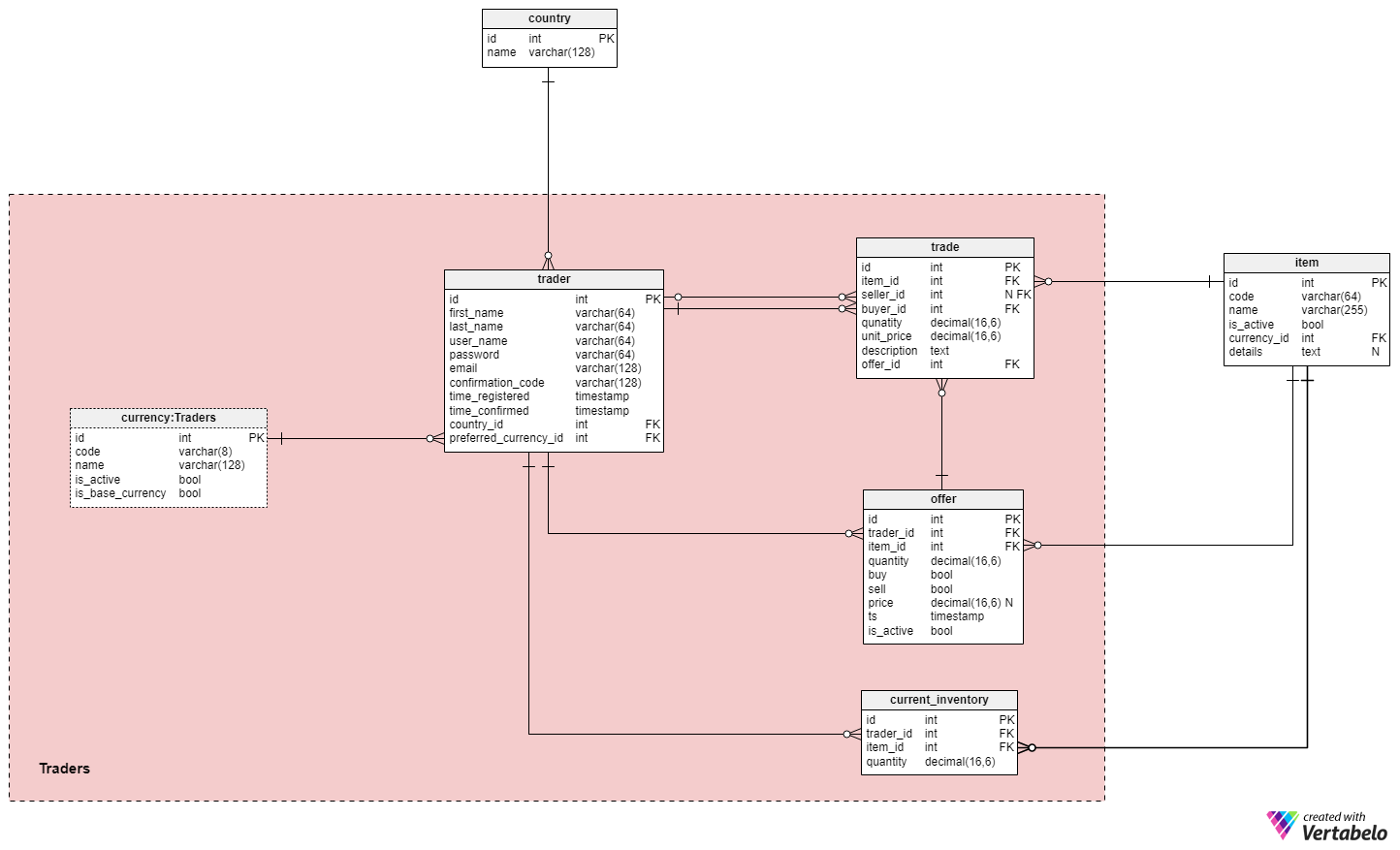

Traders

The Traders subject area is the last one we’ll discuss, but it’s the most important area in the model. Its four tables (leaving out the country and item tables that we’ve already covered) store information about traders, their inventories, and their actions. Note that the currency table used here is just a copy. It’s used to simplify the model and avoid relations overlapping.

The central table is the trader table. For each trader, we’ll store:

first_nameandlast_name– The trader’s first and last names.user_nameandpassword– The username and password (hash) chosen by the trader. Theuser_nameattribute can store only UNIQUE values.email– The trader’s email address. This will be used to complete the registration process and for all subsequent contacts with the trader. It can also hold only UNIQUE values.confirmation_code– The code sent to the user to complete the registration process.time_registeredandtime_confirmed– Timestamps of when the trader registered and when they completed the registration process.country_id– Thecountrywhere the trader lives.preferred_currency_id– Thecurrencythat the trader wants prices displayed in.

The list of all items a trader currently owns is stored in the current_inventory table. For each UNIQUE trader_id – item_id pair, we’ll store the quantity the trader currently owns.

The remaining two tables are directly related to offers and trades. We’ll assume that each trader can place an offer to buy or sell items at a certain price. When a matching offer appears, the trade event will happen. (We won’t go into details that are specific to stock exchanges, where a broker serves as a mediator.)

We’ll keep a record of all offers in the offer table. Any trader can place an offer to buy or sell items. To make this happen, we need to store the following details:

trader_idanditem_id– References thetraderwho placed that offer and theitemthey want to buy or sell.quantity– The quantity they want to buy or sell.buyandsell– If this offer is for buying or selling. Only one attribute can be set at a time.price– The desired buying or selling price. It’s not required because a trader may want to buy or sell no matter what the price is.ts– The timestamp when this record was inserted.is_active– Whether this offer is still active. It could become inactive a) if the trader sets it to inactive, or b) if the trade has taken place.

The final table in our model contains data related to the trading event. Trading takes place between two users after they both place an offer. The price used could be the first price offered or the current price, depending on what we want to implement in our application. For each trade event, we’ll store:

item_id– Refers to theitemtraded.seller_idandbuyer_id– Both reference thetradertable and denote the users involved in the trade.quantity– How much of that item was traded in this transaction.unit_price– The unit price used for this item in this trade.description– All additional details, in textual format.offer_id– The ID of theofferthat initiated this trade. Note: The first offer initiates a trade, so that’s the ID we’ll store here.ts– The timestamp when this trade happened.

What Do You Think?

We’ve just considered a data model to facilitate the online trading of cryptocurrencies, stocks, and other financial derivatives. This is just the bare bones of the model; there are a bunch of other details we could add. I’m thinking of documents related to traders and a way to store payment information. What would you add? Or maybe remove? Please tell us in the comments.