Back to articles list

Back to articles list

Unveiling the database design of a comprehensive billing system model.

A billing system is an intricate design that allows for the tracking of goods and services, the generation of invoices, and the processing of payments. It acts as the foundation for financial transactions in a variety of industries, ensuring that firms can manage their revenue streams efficiently and keep accurate financial records. In this article, we’ll discuss how to build an ER diagram for a billing system.

It’s worth noting that billing methods are not without difficulties. They frequently deal with challenges, including data redundancy, sophisticated tax calculations, discount processing, and integration with other corporate systems. These difficulties need a strong and well-thought-out design.

In the following text, we will go deeper into the billing system entity-relationship diagram. We’ll analyze its components and demonstrate how each entity functions within the system. By analyzing the billing system database model, you’ll understand the fundamental principles that drive the billing system’s functionality.

This article will serve as a reference for companies wishing to create or enhance their billing systems; it will also provide insights to ensure efficiency and accuracy in financial transactions.

What Is a Billing System?

An ER diagram for a billing system provides a visual representation of a billing system database model. It explains how the different entities and their relationships are structured. A billing system is a software system that collects, categorizes, processes, and generates invoices for services delivered or products sold. A good billing system must cover the following areas:

Invoices and Accounts

Invoice generation is one of the key functions of a billing system. These invoices list the products or services purchased or performed, their prices, any applicable taxes or discounts, and the total amount owed. To simplify direct payment processing, modern billing systems frequently link with payment gateways or banks; they can include payment methods like credit cards, bank transfers, and online payments. The database design for billing systems ensures that these processes are efficient and error-free.

In addition to these essential activities, billing systems also keep track of customer accounts: purchase history, outstanding amounts, credit limits, and payment history. An ERD for a billing system can help visualize these relationships and data flows. This system can also support thorough reporting capabilities, allowing you to see sales, outstanding debts, revenue, tax collections, and other information. Billing systems can also calculate applicable taxes automatically (based on predetermined rates) and offer discounts via promotional codes or loyalty programs.

Integrating with Other Systems

Another important aspect of billing systems is integration. Many billing systems communicate with other enterprise systems, such as Customer Relationship Management (CRM) systems, Enterprise Resource Planning (ERP) systems, and inventory management systems. This is often done in real time, which guarantees that data flows smoothly and eliminates the need for human data entry. Billing systems can also send automated reminders to consumers about upcoming or overdue bills; this reduces the number of late or missed payments.

Given the sensitive financial data they manage, security is critical to a billing system. Data encryption, secure user authentication, and regular backups must be in place. Furthermore, a billing system must meet specific industry requirements or unique company processes.

Scalability becomes increasingly important as a company's transaction volume grows. Billing systems should be able to handle increased loads without sacrificing performance.

For efficient operations, the billing system should include an easy-to-use user interface that allows staff to easily input data, produce invoices, and extract reports.

In essence, a billing system serves as a company's financial nerve center. It ensures that revenue flows are reliably tracked, reported, and managed. Its features are intended to simplify, automate, and improve billing and payment operations – ensuring efficiency and accuracy in each transaction.

Common Billing System Challenges

While billing systems are essential for businesses, they also present their own set of issues. The complexities – as shown in an ER diagram for a billing system – frequently highlight the difficulty involved in maintaining accurate and effective financial transactions. Let's look at some of these issues.

- Complex Database Design: A solid billing system database model is required for the system to run smoothly. However, creating such a model can be difficult. It is a challenge to ensure that all entities, relationships, and data flows are precisely represented and work without redundancy or errors. An ERD for billing system can aid in visualizing this complexity, but turning it into a usable database is a time-consuming operation that demands great attention to detail.

- Integration with Other Systems: It is critical that the invoicing system interfaces effectively with various platforms. However, enabling real-time data flow without lag or data loss between these systems is a common difficulty.

- Scalability: When the transaction volume increases, a billing system that works well for a small organization may struggle. Ensuring that the database design for billing systems is scalable and can manage rising demands without sacrificing performance is a major hurdle for database designers.

- Security: Because financial data is so sensitive, billing systems are potential targets for cyberattacks. It is critical to have data encryption, secure user authentication, regular backups, and other security measures in place. However, as cyber threats grow, maintaining system security becomes a constant problem.

- Regulatory Compliance: Different regions have different billing, taxing, and financial reporting regulations. It is difficult to ensure that the billing system complies with all of these rules, especially for organizations that operate in multiple countries.

- Taxes and Discounts: Changing tax rates, promotional discounts, and loyalty programs can make determining the final bill amount difficult. The system must be structured to manage these variances seamlessly.

- UX Design: While the backend of the billing system deals with complexities, the front end (the user interface) needs to be intuitive. Ensuring that staff can easily input data, generate invoices, extract reports, and perform other tasks without extensive training is a challenge in itself.

- Data Redundancy and Accuracy: It is critical to ensure that data is consistent and accurate throughout the system. However, there is always the possibility of data redundancy or inaccuracy, particularly when data is coming in from several points and when there’s connectivity with other systems.

While our ER diagram for a billing system provides a blueprint of how the system should function, translating that into a fully operational billing system comes with its own set of challenges. From design intricacies to security concerns, businesses need to be aware of these challenges and address them proactively to ensure that their billing systems are efficient, accurate, and reliable.

An ER Diagram for a Billing System

A billing system ER diagram aids in comprehending the complexities of the billing process by ensuring that all key components are included and any problems are addressed during the design phase. Stakeholders can obtain insights into the system's workings by examining the design, paving the way for a straightforward and error-free invoicing procedure.

When it comes to designing and visualizing the relationships and cardinality constraints of a billing system, data modeling tools like Vertabelo are invaluable. With its intuitive interface and comprehensive feature set, Vertabelo simplifies the process of creating an ER diagram for a billing system. It not only aids in ensuring that all entities, attributes, and relationships are correctly defined, but it also assists in maintaining data integrity by enforcing cardinality constraints. For businesses or individuals looking to design a robust billing system, leveraging the capabilities of Vertabelo can be a game-changer.

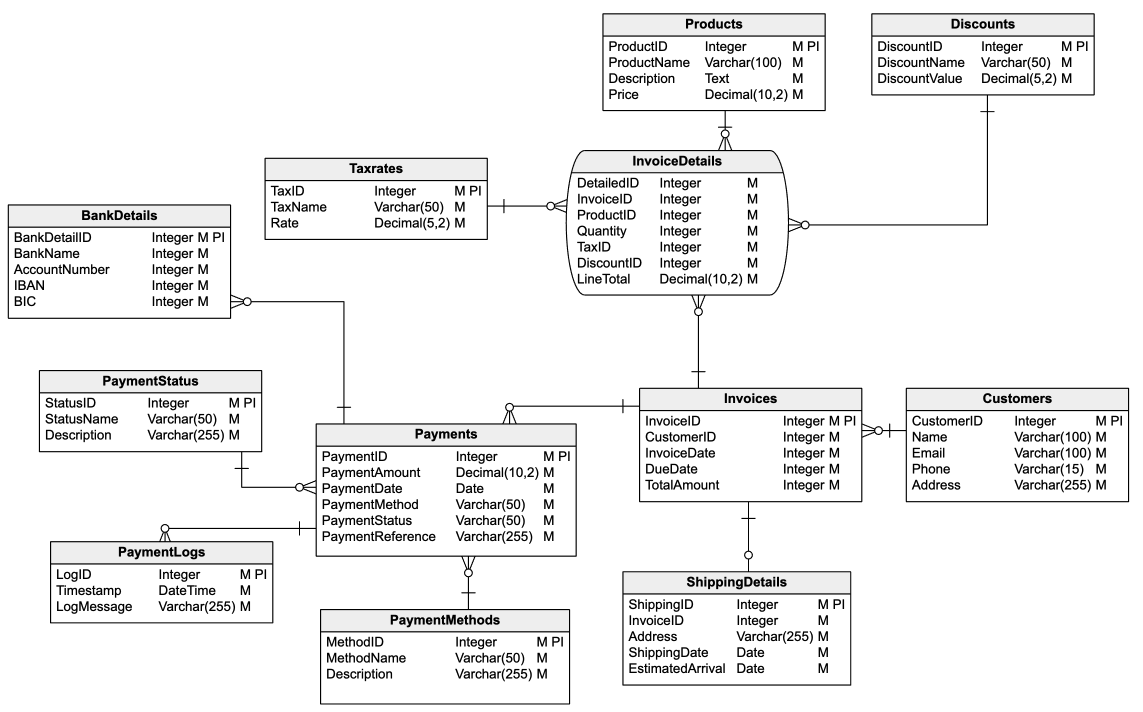

Let’s now review the major entities in the ER diagram presented above.

Entities

In the intricate landscape of a billing system, several entities stand out. The Customers entity, for instance, is pivotal: it stores comprehensive information about the individuals or companies being billed. This encompasses details such as their unique identification numbers, first and last names, email addresses, phone numbers, and physical addresses.

Another crucial entity is Products, which represent the items or services that a business offers. Each product is uniquely identified and is associated with a specific name, a detailed description, and a set price.

The TaxRates entity captures the diverse tax rates that might be applied to these products. Each tax rate is uniquely identified, has a specific name, and has a rate associated with it, which is crucial for accurate billing calculations.

The Discounts entity is essential, as it represents the various discounts that can be applied to products during promotional periods or under specific conditions. Each discount has its own unique identifier, a name, and a value that determines the amount or percentage to be deducted from the original price.

The Invoices entity is at the heart of the billing process. It captures the billing details for each transaction, including a unique invoice ID, the associated customer's identification, the date the invoice was generated, its due date, and the total amount due.

To provide a detailed breakdown of each invoice, the InvoiceDetails entity comes into play. It records the products or services billed in each invoice, the quantity of each product, and the specific tax rates and discounts applied. Each detail is uniquely identified and is associated with specific invoices, products, tax rates, and discounts.

The Payments entity logs the payments made against these invoices. Each payment is uniquely identified, linked to a specific invoice, and has details like the date of payment, the amount paid, and the method used for payment.

ShippingDetails entity is vital for businesses that deliver physical products; it captures essential shipping information for products associated with an invoice, including a unique shipping identification, the associated invoice's identification, the shipping address, the date the product was shipped, and its estimated arrival date.

The PaymentMethods entity serves as a repository for all the different modes of payment available to customers. This could range from traditional methods like "Credit Card" or "Bank Transfer" to more modern options like "PayPal" or "Cryptocurrency". By centralizing this information, businesses can easily manage and expand their payment options, ensuring flexibility for their customers. Each entry in this entity has a unique identifier, a descriptive name, and, optionally, a more detailed description to provide clarity on the payment method.

The PaymentStatus entity is crucial for tracking the lifecycle of a payment. Payments can go through various stages, from "Initiated" or "Pending", to "Completed", "Failed" or "Refunded". This entity allows businesses to define and manage these statuses in a centralized manner. By referencing this entity, other systems or processes can quickly determine the state of a particular payment, facilitating better customer support, financial tracking, and reporting.

Every payment transaction, whether successful or not, generates a trail of events that need to be recorded for auditing, troubleshooting, and customer service purposes. The PaymentLogs entity captures these events, providing a chronological record of actions and outcomes associated with each payment. This can include events like payment initiations, authorizations, failures due to insufficient funds, or even manual interventions. Each log entry would typically have a timestamp, making it easier to reconstruct the sequence of events for any given payment.

Lastly, for businesses that accept direct bank transfers as a mode of payment, the BankDetails entity is invaluable. It stores specific bank-related information associated with a payment, ensuring that funds are correctly routed and received. Fields in this entity can include the bank's name, the account number to which funds were transferred, and international banking identifiers like IBAN and BIC. Storing this information allows businesses to verify transfers, reconcile their accounts, and address any discrepancies that might arise.

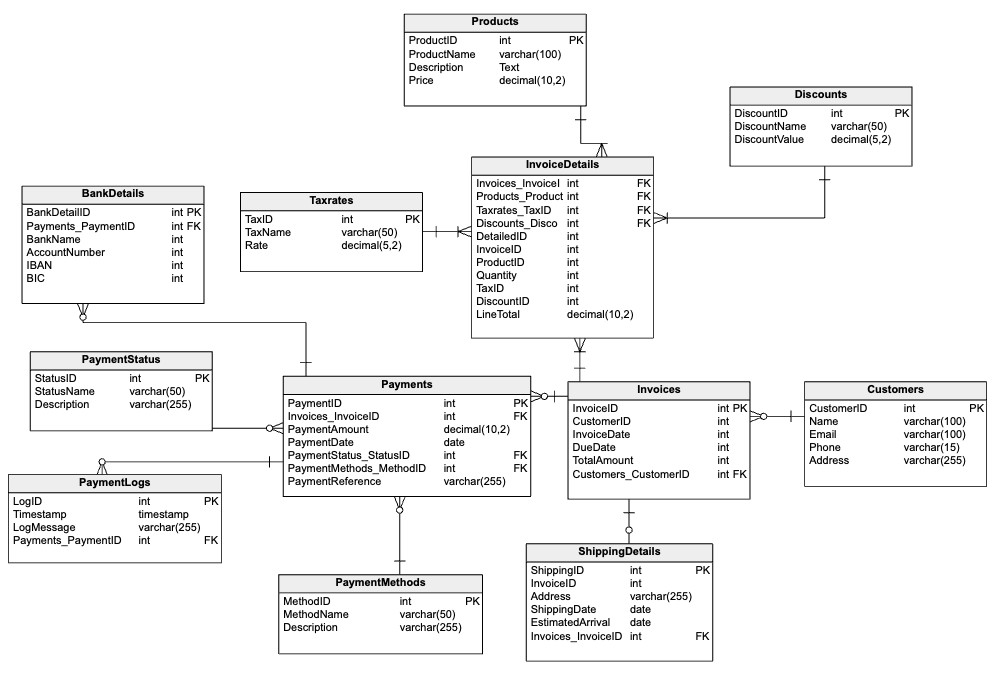

Creating the Physical Billing System ER Diagram

Once you have your logical model, it is important to turn your logical billing system model into a physical database model. The logical model is a high-level representation that focuses on the entities, their properties, and the connections between them. It does not go into specifics about how these things will be used in a database system. It's more about the 'what' than the 'how'.

Vertabelo can easily and automatically create a physical model for the database engine that you want (in this case, PostgreSQL 13, although many other popular database management systems are available). When you’ve verified that everything in your logical model is correct, you can use the DDL generation feature to automatically get the code you need to build your database.

An efficient billing system is a cornerstone in the dynamic world of business, backing every financial transaction. While the obstacles of developing such a system are numerous, tools like entity-relationship diagrams for billing systems provide crucial clarity.

As businesses strive for operational excellence, the precise design and modeling of their billing systems becomes not only helpful, but also necessary. Every well-placed item and interaction in the diagram represents a step forward in this path toward financial precision and dependability.